A decrease within the burn rate could counsel decrease community exercise, doubtlessly signaling investor hesitation. Thus, having dependable answers to such questions is crucial for investors. Cryptocurrencies, digital or virtual currencies, rely on cryptographic methods for secure online transactions, eliminating the need for intermediaries. The term “crypto” encompasses encryption algorithms and techniques like elliptical curve encryption, public-private key pairs, and hashing capabilities. Just upload your form 16, declare your deductions and get your acknowledgment number on-line.

Sentiment on social media platforms like Twitter, Reddit, and others influences the index. Positive or negative discussions can influence investor sentiment and, in turn, the index rating. This is majorly influenced by traders appearing out of concern and greed. A falling market makes them fearful, leading to panic gross sales, whereas a bull market makes them grasping, and so they begin accumulating. Cryptocurrency operates independently of the inventory market, but some specialists argue a significant hyperlink exists between cryptocurrency costs, corresponding to bitcoin, and the inventory market.

At Codezeros, we’re enthusiastic about the means ahead for blockchain know-how and Ethereum software growth. We offer a complete suite of companies for businesses on the lookout for Ethereum pockets integration. If you’re excited about exploring the potential of Ethereum or different cryptocurrencies, we invite you to contact us right now.

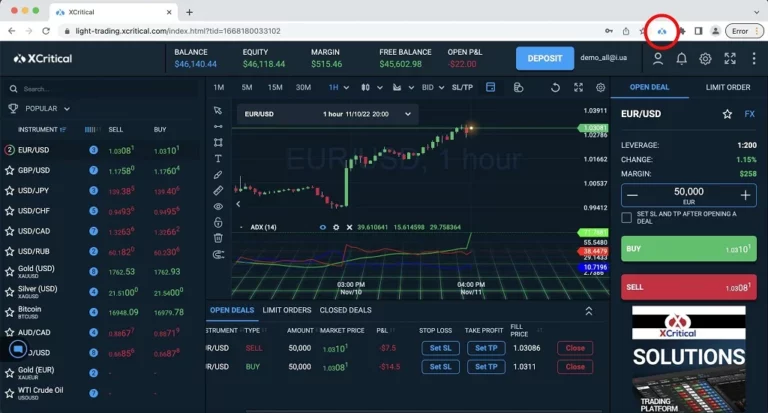

Popular In Markets

Undoubtedly, predicting future movements of cryptocurrency assets with perfection is inconceivable. But there are some indicators like Fear and Greed Index, which offer actionable insights. Thus, it’s crucial for potential traders and crypto enthusiasts to grasp this index’s construction, what it captures and what it says in regards to the market. Skilled choices traders can capitalize on this volatility by using various methods. For example, promoting options contracts when IV is excessive can be a lucrative strategy if the underlying asset value stays comparatively stable. However, options buying and selling requires a classy understanding of the risks concerned and isn’t suitable for all investors.

- For those considering options methods, it is essential to assume about the following implications.

- As the global monetary landscape evolves, the line between traditional and digital property could turn out to be increasingly blurred.

- Our consultants suggest one of the best funds and you could get excessive returns by investing instantly or via SIP.

- Interestingly, on-chain knowledge would possibly corroborate this narrative of uncertainty.

- Stocks symbolize established investments linked to actual companies, while cryptocurrencies present contemporary opportunities within a dynamic digital sphere.

The purple line represents the RSI, while the yellow line is an RSI-based Moving Average (MA). This index compares max drawdowns (a drawdown is a decline in value) and volatility against cryptocurrency volatility index 90-day and 30-day average volatility and drawdown numbers. Greater volatility is seen as fearful and results in an increase within the final output.

The successful implementation of upgrades may strengthen its network and entice wider adoption. Regulatory readability might also pave the way in which for increased institutional investment. One key contributor is the upcoming roadmap of upgrades planned for the Ethereum network.

The Method To Use The Crypto Worry And Greed Index?

Each block holds verified transactions independently validated by network validators. Several traders make use of this index as a market indicator, a software which provides them with data related to the market, thereby serving to them to commerce smarter. Analysing the general emotions and sentiment driving the market has helped a number of traders outperform the market. The RSI is a useful device for gauging whether an asset is considered overbought or oversold in the quick time period. By analyzing the RSI alongside worth actions, we are in a position to doubtlessly establish areas of buying or selling stress.

In contrast, Ethereum’s volatility index shows a extra modest lower, dropping from 76% to 65% in the identical timeframe. This larger stage of volatility compared to Bitcoin signifies that the market remains unsure about Ethereum’s future value actions. Bitcoin’s volatility index has undergone a sharp decline, dropping from a peak of 72% close to its newest halving event to round 55% presently.

Similarities Between Inventory Market And Cryptocurrency

However, a rejection by the SEC may set off further market turbulence. Typically, crypto exchanges levy fees ranging from zero.1% to 1% per trade. Blockchain know-how, basic to Bitcoin and other cryptocurrencies, consists of interconnected blocks of data on a digital ledger.

This suggests the market anticipates a period of relative stability for Bitcoin, with smaller worth fluctuations in the near future. This is partly because of emotional investors reacting to the market. Individuals can have a FOMO (Fear Of Missing Out) feeling, which may make them greedy when the market goes up.

Stock Market Vs Cryptocurrency: What Are The Differences?

For instance, an RSI consistently above 70 might point out overbought circumstances, whereas an RSI persistently under 30 would possibly suggest oversold situations. One notable consequence of high IV is the influence on possibility premiums. Options contracts for ETH will doubtless be priced significantly greater in comparison with a scenario with a lower IV.

It acts as a forecast of potential worth fluctuations – the next IV suggests the market anticipates vital worth fluctuations in both path. In less complicated phrases, IV displays the market’s notion of an asset’s potential worth fluctuations in the future. To make investments wisely, contemplate your targets, risk tolerance, knowledge of the asset class, and time obtainable for administration. Evaluate elements such as asset volatility, regulatory circumstances, potential returns, and your curiosity within the represented technology or firm.

To mitigate dangers, it’s advisable to carry shares as part of a long-term funding technique, allowing time to get well from short-term losses. Bitcoin, the main digital foreign money, commands a market value exceeding $800 billion. This surge has enticed buyers, a lot of whom dive in with limited understanding but high hopes. Here’s a better look at the value chart alongside a key technical indicator to supply additional insights into Ethereum’s (ETH) present market habits. However, for options merchants, this volatility can be a double-edged sword.

Lesser the Bitcoin’s dominance, the greedier the market is more probably to become. Ethereum’s excessive implied volatility presents both challenges and alternatives for investors. For these considering options methods, it is important to suppose about the next implications. Bitcoin’s dominance within the general crypto market impacts the index. A greater Bitcoin dominance could suggest greed, whereas a decrease dominance may sign fear. The price at which costs change, along with buying and selling volumes, plays a major position.

Benefits Of Investing In The Stock Market

You can efile income tax return in your earnings from wage, house property, capital gains, enterprise & profession and revenue from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, verify refund standing and generate rent receipts for Income Tax Filing. Fear and Greed Index measures the present quantity and momentum of the market in opposition to the 90-day and 30-day averages. High momentum and quantity are thought of negative metrics and raise the ultimate index output. CNNMoney developed this Fear and Greed Index to measure two main emotions which affect how much investors want to pay for stocks. This Fear and Greed Index is measured on a yearly, monthly, daily and weekly foundation.